FAB Mobile Banking helps to manage your finances without any problem. FAB Mobile Banking has created a secure, easy, and reliable user app that puts you in control of your finances.

Whether checking your balance or sending money to someone, it’s easy for anyone to use. It’s not too difficult; whether you’re tech-savvy or not, you can manage your money better.

What Is FAB Mobile Banking

FAB Mobile Banking is Abu Dhabi Bank’s first mobile app designed to offer you banking services through your smart mobile phone. So that you can easily access your accounts, cards, and payments securely and efficiently. You won’t need to visit any branch in your city.

Top Features Of FAB Mobile Banking

Instant Account Overview: If you create an account, you can check your account balance and view your transaction history without having to log in again and again.

Full Card Control: You can also activate or block your credit and debit cards and set as many spending limits as you want.

Free Global Transfers: If you have a friend or acquaintance living in another country and you can send money to them directly at any time without any hassle, there are no transfer fees.

Bill Payments Made Simple: You can also easily pay your utility bills, house rent, and electricity bills with this application.

Real-Time Document Update: Furthermore, you can also update your Emirates ID, visa, and passport via notification using this app.

Latest Updates in FAB Mobile Banking 2025

Multi-Currency Account Opening: With the FAB Mobile Banking app, you can open your USD and GBP multi-currency accounts in seconds. All you have to do is tap.

Official Stamped Statements: You can use the FAB Mobile Banking app to pay for visa applications, rent, or business use, or download bank statements.

IPO Investment Access: You can access IPO listings and investment opportunities quickly, easily, and securely from this app with your investor number and stay ahead of the market level with IPO without any hassle.

Advanced Credit Card Services: With Realtime, you can apply for balance transfers and convenient payment plans directly within the app.

Personalized Offers & FAB Rewards: You can earn FAB rewards on every transaction with your profile. You can also view and redeem your rewards for points.

Is FAB Mobile Safe To Use?

Yes, the FAB mobile app service acts as a digital security system for your transactions and data history, including biometrics such as face scans, fingerprints, and Emirates ID verification.

How To Start Using FAB Mobile Banking

Getting started is very easy:

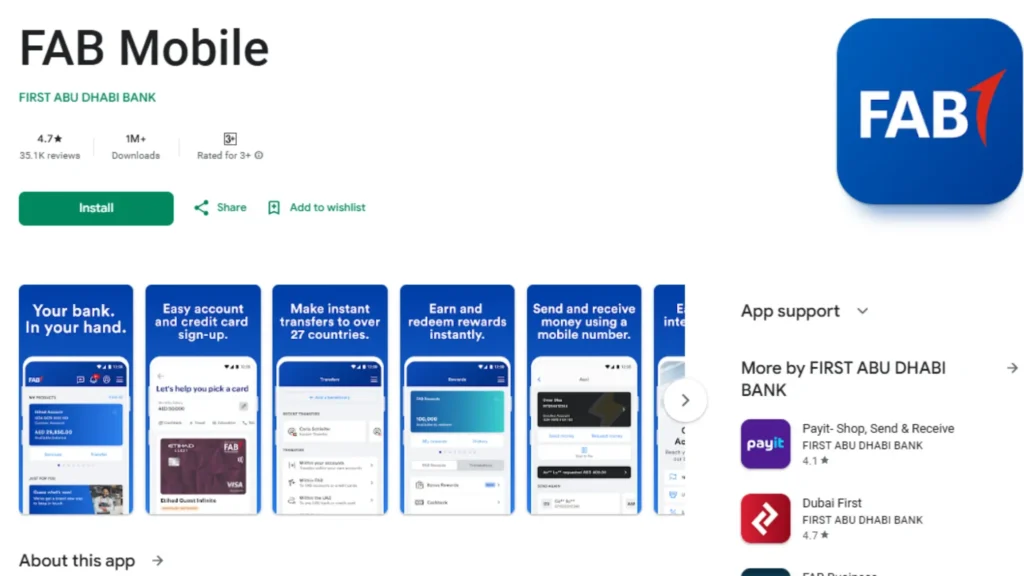

Download the app: If you have an Android mobile, you can download this mobile banking app from your Google Play Store, or if you have an iPhone, you can download it from your Apple App Store.

Register Securely: After downloading the app, register your Emirates ID and mobile number, and then identify yourself with OTP and biometric verification.

Verify & Explore: If you wish, you can first verify your identity by recognizing your face, and then you can start managing your finances.

FAB Mobile Banking App

The FAB Mobile Banking app from First Abu Dhabi Bank helps customers manage their finances better, safer, and more conveniently anytime, anywhere.

Key Features:

- Review your balance, view your transactions, and download e-statements.

- Turn your cards on or off, set your spending limits, and enter your PIN.

- Free multinational money transfers and UAE bill payments with this FAB mobile banking.

- Using for a loan, credit cards, or applying for an IPO

- Correcting your Emirates ID and Passport in the Mobile Banking App

- Opening and closing your USD, GBP, EUR, and your investment accounts

- Checking FAB Rewards and taking advantage of special offers

Security System:

Biometric login with front face scan, fingerprint, and Emirates ID verification; end-to-end encryption.

Recent Updates:

1. (Full credit card curriculum, EP, fast cash, quick balance transfer)

2. Opening FAB Security System Investment Accounts via the App.

FAB Mobile Banking 2025: Easy Benefits for Expats, UAE Locals & Business Users

FAB Mobile Banking is created for everyone in the UAE. Here’s how it allows different styles of users:

For Expats:

- Send money to family in the US, Pakistan, the Philippines, and Bangladesh without any transfer fees.

- One app can help you arrange all of your FAB accounts and cards.

- Review your balance and visiting dealings at any time.

- Use the app securely by logging in with your fingerprint or facial recognition.

For UAE Nationals:

- In just seconds. Pay your bills, including DEWA, Etisalat, and more.

- Submit your application for IPOs directly through the app.

- Get prompt assistance for loans and credit cards.

For Business Owners & Freelancers:

- Download stamped bank statements for visa access or contracts.

- You can open accounts in different currencies, such as USD, GBP, or EUR.

- Save all your business expenses in one location.

- Consider using benefits such as Fast Cash, Balance Transfers, or Easy Income Plans.

FAB Mobile Banking FAQS

What do I do when I lose my phone?

Please contact FAB’s 24/7 customer care immediately to freeze your account and secure access. Please contact FAB’s 24/7 customer care immediately to freeze your account and secure access.

I forgot my login information. What should I do now?

To reset your password, select “Forgot Password” on the login screen and follow the steps provided for secure recovery.

Is it safe?

Yes, definitely. The application uses facial and fingerprint recognition, along with strong encryption and two-factor authentication, to protect your data.

What services are available through the FAB app?

You can check your account balances, transfer money locally and internationally, pay bills, apply for products, and track transactions in real time.

Conclusion

We have provided all the information about the Fab Mobile Banking . Its latest updates, benefits, and FAB online banking App. You must like the guide and information. With the above method, you can easily download and run the app. For more information, you can see the article on our website.